25 December 2011

Recap on The Performance of Global Economy

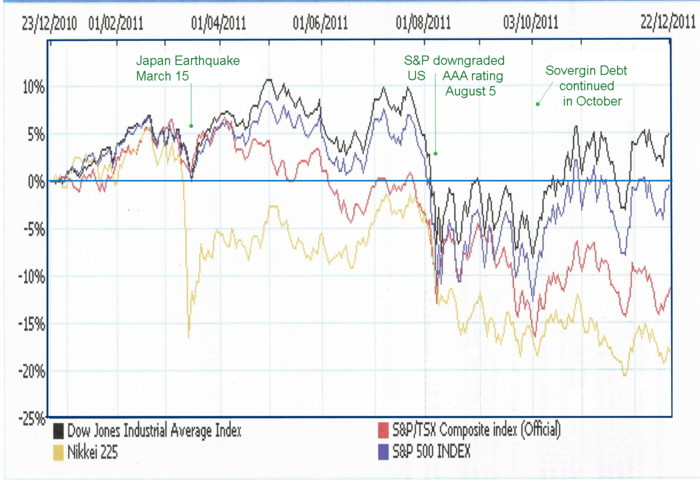

Most people said it has been tumultuous. There were the set-back due to the costly Japan earthquake in March,

the unnerving political rankling about debts and the consequential downgrading of US bond ratings by Standard and Poor's,

the continuing crisis of sovereign debt in Europe, and the marked slowdown of economic activities since mid-summer

(as reflected by the stock markets in figure below) . However, the global economy finally held out.

Even Japan has resumed its recovery track in the third quarter. Thus, no nation is now in recession.

Indices of Stock Market: Dow Jones Industrial, S&P 500, Canadian's S&P/TSX, Japanese's Nikkei

The talks about a double-dip global recession has now subsided for this moment, nevertheless the economy

is still very weak. Economists and analysts warn a possible brief recession in Europe next year. China has

a lower output in manufacturing but basically beaten rising inflation, and is expected to ease its monetary

restraints to boost domestic consumption. Canada registered a small contraction in the second quarter but

a strong recovery in the third quarter. However, the low global demand of commodities has finally suppressed

the relatively solid Canadian output. The U.S. economy has been growing a little but its unemployment

level is still high. Moreover, there are a lot of uncertainties and instabilities elsewhere in the global

economy.

On the whole, the future is not filled with glooms. One can be optimistic about the problems in the developed world.

In videos of the Internet, Japanese and European analysts appeared to be confident that their countries could

soon resolve the current difficulties in 2012. Americans also appeared to be more upbeat just than a couple of

months ago; next year is the U.S. presidential election year and the U.S, economy had been generally more positive.

In conclusion, the global economy seems to be still good in the near future to the end of 2012, barring from

unexpected circumstances. Investors, you and me, should, however, not relax the exercise of prudence in investing. There

will likely be many uncertainties in all arenas, for example: the clamoured political changes in Russia,

fighting in central Asia and the Middle East, climate changes, natural disasters, etc.

© sissi.gordoncorner.com All Rights Reserved

Sissi -

Perspectives

Sissi -

Perspectives