Economy — A Difficult 2012 and A Hopeful 2013

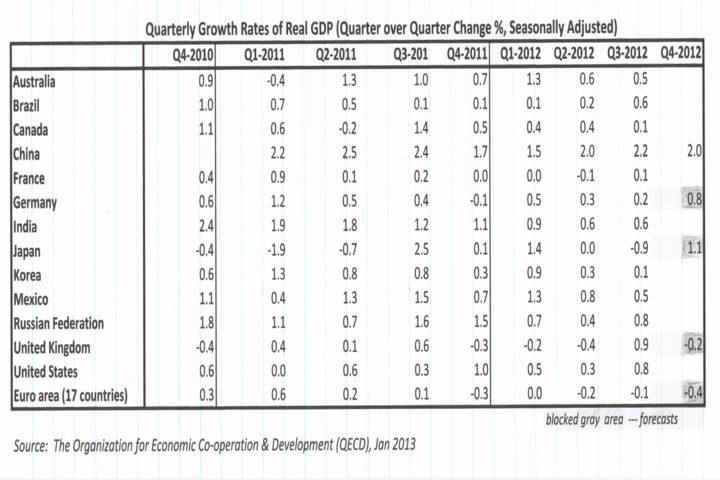

The global economy has gone through a very difficult year in 2012, many nations had gone in recession or undergone a sharp slowdown (Table 1).

There were social unrest and civil disobedience correspondent with the severe austerity measures taken by governments to cut their debts.

In the year, several nations had changed their governments, for example: France, Japan and South Korea.

According to a 1990s party rule that limits the term of all leaders to 10 years, China also replaced its leaders peacefully in November, and

after a bitter election campaign, President Obama was re-elected.

There were also many confrontations of nation against nation, for example Japan against China, Hamas against Israel, and Pakistani against India.

A very bloody civil war is also being waged in Syria.

Fortunately, none of these crises had accelerated to wider conflicts and the global economy basically continued to struggle in its slow and precarious recovery in 2012.

The growth of global economy is forecast to be 3.5% for 2013 (3.2% for 2012);

the estimate is above that of the World Bank based on a firmer American housing recovery and a mild upturn in most developing countries

(Ref: Bank of Montreal Economics Research).

The following table lists the gross domestic production of several economies from the last quarter of 2010 to the last quarter of 2012:

Table 1. Real Gross Domestic Production (GDP) of Major Economies, 2010-2012

Data Source: Reuter' s survey — forecast of Germany GDP (Q4, 2012)

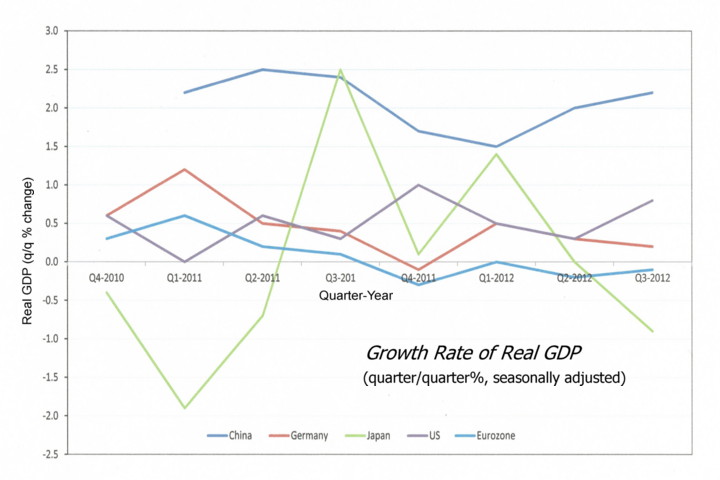

and the following shows a simplified graph of the GDP data:

Figure 1. Real GDP of U.S., China, Japan, Eurozone and Germany

[ Middle | Bottom ] of Page

The United States and Canada

Over 2012, the media had been keen on the popularly-dubbed fiscal cliff when a bundle of expiring tax cuts and

spending cuts of the American federal budget was to become effective 31 December 2012 and shortly after.

The combined effect of these tax cuts and spending cuts was believed to send America and probably the world to a mild recession.

Losing the confidence in the political leaders, the sensitive capital and equities markets would also dive immediately and cause severe turmoil in the economy.

The crisis was due to two different philosophies on public spending and budgeting in the United States — conservative Republican's and liberal Democrat's.

It came to a stand-off between the two parties to the end of the deadline and until after they finally compromised on a last-minute deal on New Year's Day - technically still within the deadline.

The compromise essentially addressed the tax issue where almost all taxpayers pay with the well-off pay more,

but dealt with debts and spending issues later. On 22 January 2013, the U.S. Congress also extended the debt ceiling

(1.64 trillion dollar imposed by previous legislation) to May 2013 so the Treasury could function with more money.

Other than these fiscal problems, the economy is doing not too bad. In fact, it outperformed many those of other developed countries.

The real GDP growth would reach 2.3% in 2012 in comparison to the 1.8% in 2011.

The inflation rate would be 2.0% in 2012; that of 2011 was 3.2%. The real estate market has also been recovering throughout 2012.

More importantly, the unemployment rate has been falling slowly but steadily - from the high recession level at 10% (2009) to 7.8% in the Q4 of 2012 (Fig.2).

Figure 2. U.S. Unemployment Rate — 1970-2012 (Source: Bureau of Labor Statistics)

It is likely the U.S. Congress will compromise again on a solution on public spending cuts and borrowing, at least in the short-term in 2013.

The present positive business activities and consumer spending would keep up the momentum of American economy for the whole year.

Some analysts now forecast an annual Real GDP growth of 2.4% and an unemployment rate of 7.6% for 2013 (Table 2).

| 2012Q1 | 2012Q2 | 2012Q3 | 2012Q4* | 2013Q1* | 2013Q2* | 2013Q3* | 2013Q4* | |

| Canada | 1.7 | 1.7 | 0.6 | 1.6 | 2.4 | 2.7 | 3.4 | 3.2 |

| U.S.A. | 2.0 | 1.3 | 3.1 | 1.4 | 2.0 | 2.7 | 3.0 | 3.3 |

| * Seasonally adjusted annualized rates | ||||||||

|---|---|---|---|---|---|---|---|---|

Source: RBC Economics Research (Financial Markets Monthly, 8 Jan 2013)

[ Top | Bottom ] of Page

Canada

With weak demand of exports, a cooling real estate market, a high level of consumer's debt and a cut-back of government spending,

the economy growth has markedly declined to 0.6% in Q3 and been struggling to achieve a 1% in Q4 of 2012.

Economists now estimate a 2% growth forecast for 2012 in comparison with the 2011 figure of 2.6%.

More potentially troublesome arenas are the merchandise trade deficit that has widened to C$ 1.96 billion in November

and the downgraded ratings of provincial bonds (Ontario and Alberta) that are under watch status by rating agencies.

Normally, the stronger Canadian dollar would appreciate against the

US dollar that would fall under the 4th round quantitative easing (QE4) augmented by the U.S. Federal Reserve last December.

Now the Canadian dollar is now close to at par with the US$.

The weakness of economy may be reflected by the Canadian stock market that was decoupled from the trend with the American market in 2011 and has been lagging behind.

Many energy and mining companies had seen their market capitalization halved in 2012; several energy companies has started or are about to amalgamate themselves.

To counter the slow foreign demand, Prime Minister Steven Harper journeyed to Asia last year to invite investors to invest in Canada.

His efforts had led to some surprise responses from China, Malaysia and India, who asked to invest directly in Canadian natural resources.

The surprises had sent the Canadian government into a dilemma and had stirred a strong outcry from the opponents and the public against these investments.

With the unease in the memory, future foreign investors might proceed more cautiously in putting their capitals in large investments which are badly needed by Canada.

All in all, Canada economy is still very healthy with an inflation rate well below the 2% target and a decent employment rate (a low 7.1% in Q4-2012).

The real estate market is probably just going through a temporary soft patch.

With the ever-integration in the North American economy, Canada would grow with a faster pace again when America imports more goods in the rebound in 2013.

China

In 2012, China's economy had been running at the slowest pace during the past ten years.

According to China's National Bureau of Statistics, the GDP achieved 51.93 trillion Yuan (8.28 trillion US$) among internal economic pressures and external trading problems,

in comparison with the 2011 figure of 7.30 trillion US$ (IMF record - Oct 2011). The changes of GDP growth rates are: 10.4% (2010), 9.3% (2011) and 7.8% (2012);

however, her economy seems to be picking up steam. A quarterly 7.9% rate of GDP growth was announced for the

last quarter of 2012 and a 8.1% is estimated for the first quarter of 2013 (Table 3). Some economists think the

economy will grow at about 7.5% rate for 2013, although a Bank of Communications report predicts a 8.5% rate

with domestic demand being the driving force and a bottoming-out of slump in Europe.

Nevertheless, the new Communist Party of China leaders might continue with a cautious approach to harness

the once-over heated economy with more concerns on quality growth, pollution concerns and stabilization of domestic reforms.

| 2011 Q3 | 2011 Q4 | 2012 Q1 | 2012 Q2 | 2012 Q3 | 2012 Q4 | 2013 Q1 | |

| Quarter, Year | 9.1 | 8.9 | 8.1 | 7.6 | 7.4 | 7.9 | 8.1 |

Source: Tradings Economics (www.tradingeconomics.com/china/gdp-growth), Jan 2013

Other Economies - Japan, Eurozone & Germany

Japan

The Japanese economy was in the danger of sliding to another recession with a negative -0.9% growth in Q3 of 2012 amidst its persistent deflation.

Its annual trade deficit was also widened to 6.93 trillion yen (78.3 billion US$) in 2012 with declining exports at -5.8% and increasing imports at 1.9%.

The newly elected Prime Minister Shinzo Abe vowed to pull Japan from its recent slump and has pressured the Bank of Japan to take action.

This January, the bank revised the inflation target to 2% from 1% and has started to aggressively

ease its monetary policy with massive bond purchases (10 trillion yen or about 116 billion US$).

Meanwhile, the government also introduced a massive stimulus package of 10.3 trillion yen to boost domestic

consumption in conjunction with the measure to weaken yen to make Japanese goods competitive.

Economists now anticipate a 1.5-2% growth of GDP in the first quarter of 2013.

Risks

Government officials from Russia to Germany have voiced concerns about Japan's latest move to weaken

the yen against the US dollar. This manipulation could cause havoc in global capital markets and initialize a currency war.

Furthermore, the huge stimulus are criticized to be too large for Japanese capacity to absorb even though its

different financial structure is quite unique (its public debt/GDP ratio is nearly twice of the United States).

[ Top | Middle ]

Eurozone

Against the pessimists' expectation, the Eurozone did not break apart in 2012, though the legacy of the "Sovereign Debt"

crisis may still linger on and the euro area is now in recession. IMF estimated the real GDP had contracted by 0.75% on an annualized basis

for the second half of 2012 and 0.4% for the whole year. With less budget cuts, the financial conditions of the euro area

should be stabilized in the first half of 2013 and might see some growth in the second half — a likely 1%.

The European Central Bank (ECB) is expected to keep an accommodating monetary policy to improve economic growth.

Moreover, the political willpower would continue to hold up the currency union against regional political and social unrest and to mitigate uncertainties there.

Germany

The latest report (15 Jan 2013) from the German Federal Statistics of Office (Destatis) showed the Germany economy, the largest economy

in Europe and the world's fifth (Table 4), shrank by 0.5% in Q4 of 2012. The real GDP growth for 2012 is now revised to 0.7% from 1.0% (Table 5).

| EU | US | China | Japan | Germany | |

| GDP | 17.61 | 14.99 | 7.20 | 5.87 | 3.60 |

Source: International Monetary Fund (Oct 2011)

| Year | 2009 | 2010 | 2011 | 2012* | 2013* |

| GDP | -5.1 | 3.6 | 2.7 | 0.7 | 0.4 |

| * estimate or forecast | |||||

|---|---|---|---|---|---|

On 21 January 2013, Bundesbank, Germany's central bank, said the economy could have already bottomed out and there would likely not be a protracted slowdown.

The recent contraction is expected to be short-term, as Germany still has a very robust foreign trade and healthy spending by the government and the consumers.

Thus, the investor sentiment and the confidence level of businesses have recently risen, even though the key trading partners of Germany are still in recession.

Improving signs indicate future growth of the labour market, the export trade and the corresponding import trade for 2013.

The stronger German economy could be able to continue its leadership role in the union and the support of the euro.

Future

Barring unexpected and unforeseen circumstances, the global economy should still be growing (slowly) in the recovery phase of the business cycle, with the year of 2013 outperforming 2012.* This article is written for personal references only. No advice, nor qualified idea & nor opinion are given; also no accuracy of figures are guaranteed