Stock Market Strategies for 2009 to 2011

My Stock Portfolio

In the summer of 2008, I was inspired by an American movie "Pursuit of Happyness" - a real life story of a stock broker struggling from rags to riches.

And, I decided to try working harder with my investment portfolio. When the market collapsed in October,

I continued even to invest more in the market. In the beginning of 2009, I tried a new strategy/plan to see if the portfolio would sink or float.

The plan

The portfolio was gradually diversified to handle the board drop of market.

The rationale and hope was a diversified lot may allow at least some of small holdings of these stocks to survive in the volatile down turn. It turned out

none of these stocks had gone into financial difficulties. At most, two were merged or bought out, with a good return of the investment.

One of the major requirements in the stock selection is the yield of stocks. Usually, only established companies pay dividends.

An announcement of dividend cut alerts you to review the company.

Almost all in the portfolio had a good track record of dividend payouts; many were Canadian income trusts.

Here, a minute observation of small to medium cap companies (by Canadian classification): the executives,

the retired employees and unions often own their stocks; they might pay more attention to dividend payout and the stock prices.

During 2009 and 2010, only a few stocks in the portfolio cut dividends and their prices dropped sharply.

These stocks provided a steady stream of cash and a foundation for the portfolio in the past two years.

This dividend-income foundation was coupled with trading of some aggressive growth companies.

The Result

The portfolio navigated into positive performance in 2009 and 2010. Last year was 46% comparing to the -34% in 2008.

This year, the performance wass 16.2% up to end of September, and is expected to end up higher for the whole year.

The portfolio and other incomes should made my gross income reach a record - probably

several thousand above that of 2005 when I had a union job working 60 hours per week for over half a year.

The following are the rate of returns of the portfolio:

Quarterly Performances(%) for 2009 and 2010

The % of the account is calculated by my broker with the consideration of deposits, withdrawals, accrued interest and market values.

2010 2009

---------------------------------------

Quarter 1 9% -14%

Quarter 2 -7% 20%

Quarter 3 10% 19%

Quarter 4 N/A 13%

---------------------------------------

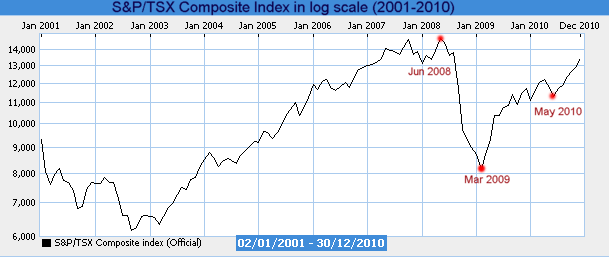

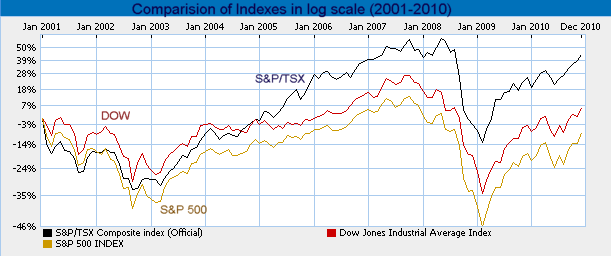

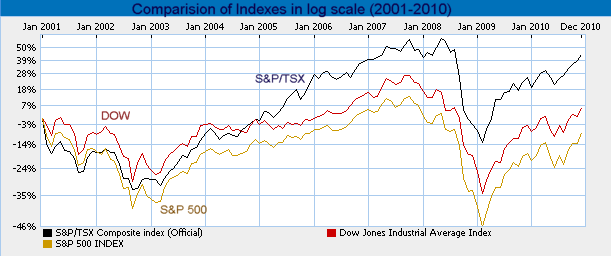

Year-to-date Benchmark Comparison against Indexes

-------------------------------------

Portfolio 16.2%

Candaian T-Bill 0.3%

SP/TSX Composite index 12.9%

S&P 500, C$ 5.4%

DOW, C$ 5.8%

-------------------------------------

Outlook for 2011

"Could the DOW set a record high next year?" It is the title of the article written by Stan Choe for The Associated Press on 17 December 2010.

Succinctly, his analysis of the stock market covers from the start of the recession to the present recovery.

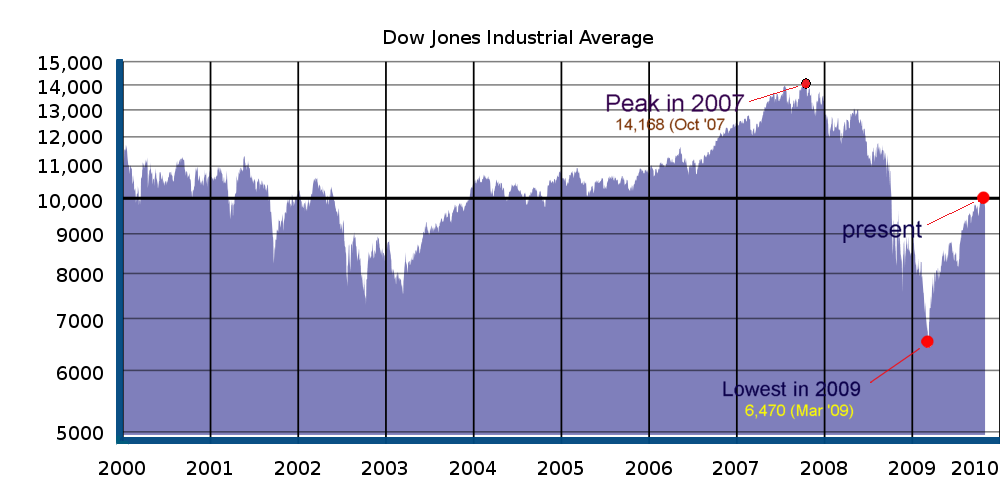

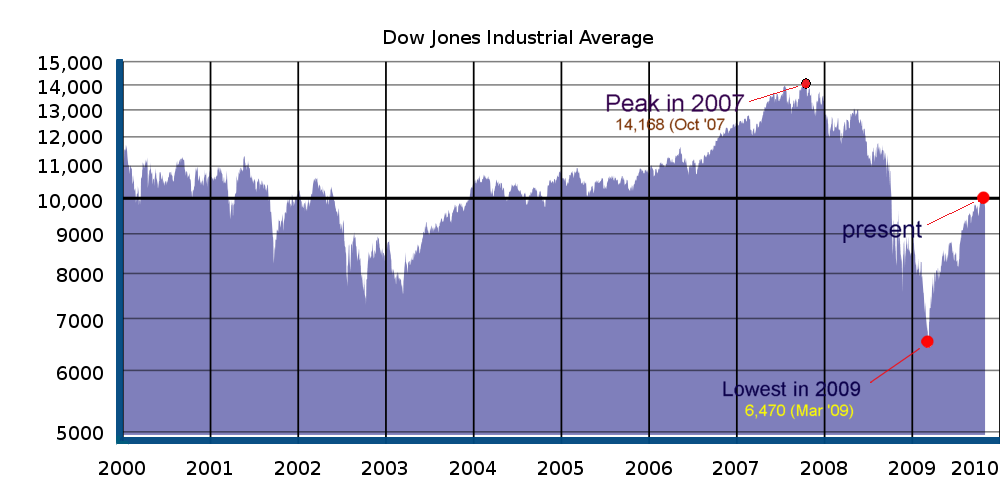

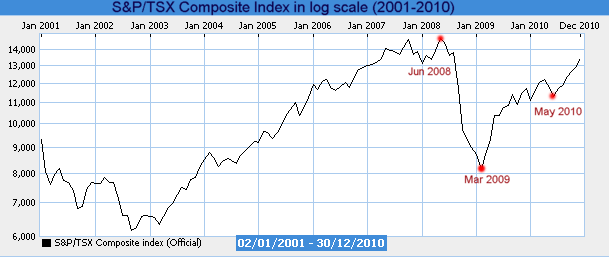

DOW reached the peak at 14,168 in October 2007 and plunged to the trough at about 6,470 in March 2009.

The market now was about 11,550 on December 31, 2010, a 77% rise in 22 months.

For 2010, DOW rose 10 percent despite "serious problems lingering in the economy,

including a 9.8 percent unemployment rate and a weak housing market."

So, the market is now in a good position to continue the rally and could reach a record in 2011.

However, he cautions that slow growth of DOW was common in the market rallies past 25 years

and the government deficits could send DOW lower in 2012 or 2013.

His informative article says the stocks are able to appreciate in the economic uptrend.

As the economy improves, the corporations will have more money to pay bigger dividends,

to buy their own stocks or to buy their competitors. This view point is enforced by the recent activities:

many companies have raised dividends, some plan to re-purchase own stocks, and quite a few announced buyout deals.

The following charts show the movement of the market indexes for the past decade:

Source: Wikipedia/DIJA_2000_graph(log).svg

Plan for 2011

With apprehension, I am pondering about a future plan for the portfolio and wondering if its past performance could be repeated in 2011.

One reason is that a new Canadian tax rule shall be implemented on January 1, 2011 for income trust funds.

Income trusts shall be taxed the same as corporations. The changes are applicable to income trusts that started after October 2006.

The cash income had been paid in the form of interest with no holding tax for Canadian investors,

but the income will be paid in dividend for which the corporations have

to deduct federal tax before the same income is sent to the investors.

The sum will be smaller if the original payout rate does not change,

although the loss of income will be recovered at the time of annual tax return for Canadian investors.

At the moment, all but the real-estate funds (REIT) and a few will remain.

It is uncertain how non-Canadian investors view the new rule.

This year, some income trusts already changed into corporations, but their stock prices suddenly dropped and have not yet recovered at the change.

The world is still saddled with financial problems. Many western governments carry a large deficit.

Also, the debt loads governments and its citizens are still very high. The problems will affect the global economy and the rally of the stock market.

Optimistically, the stock market should continue to sail on an upward trend, but the environment would be unpredictable and choppy sometimes.

At this moment, I have further widened the breath of the portfolio from 40 to 50 stocks in order to match the future movement of the market.

I have not yet to devise a concrete strategy. My old knowledge would need to be re-tested.

For example, the paper printing industry often lagged in the recovery of past recessions.

I may consider trying some feeler tactics to finalize a new strategy for 2011.