15 September 2014

Summary on Global Economy in 2014

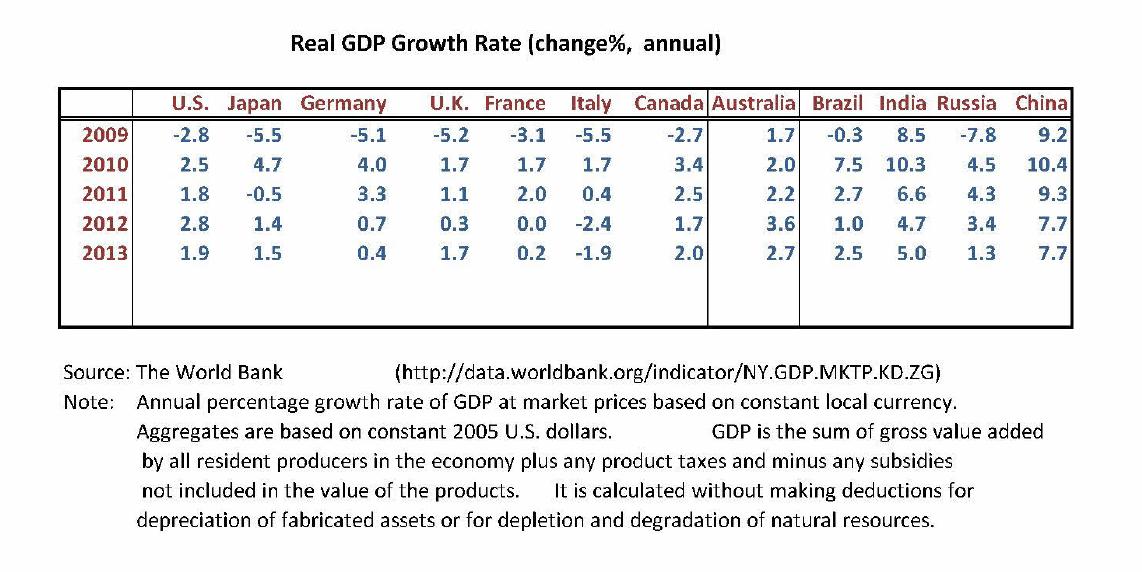

2013 had been a good year for the global economy with improving situations in most developed countries and emerging economies (Table 1).

Because of the changing geopolitical pictures in Europe, the Middle East, Asia and, to some extent, Africa, the optimism of a robust global recovery fades in 2014. For developed countries, The United States and The United Kingdom have achieved outperforming growth in 2014, but that of France was flat, and those of Germany and Japan contracted in the second quarter (Table 2). Most emerging economies still managed positive performances, though the rates were slowed.

(% change compared with same quarter of previous year)

| 2013 Q3 | 2013 Q4 | 2014 Q1 | 2014 Q2 | |

| United States | 1.1 | 0.9 | -0.5 | 1.0 |

| Euro Area | 0.1 | 0.3 | 0.2 | 0.0 |

| Japan | 0.4 | 0.0 | 1.5 | -1.7 |

| Germany | 0.3 | 0.4 | 0.7 | -0.2 |

| France | -0.1 | 0.2 | 0.0 | 0.0 |

| Italy | -0.1 | 0.1 | -0.1 | -0.2 |

| U.K. | 0.8 | 0.7 | 0.8 | 0.8 |

In the first half of 2014, China expanded by 7.4 percent but its economy had softened since then.

In a speech at the Summer Davos Forum on September 11, Premier Li Keqiang said China would attempt to reach its annual growth target of 7.5 percent

by implementing reforms in capital management and the development of private sectors. Nevertheless, he cautioned that one should not just focus

on China's short-term performance or the performance of a particular sector and rather at the overall trend, the bigger picture and the total score.

Foreign observers think China's economy is large and complex and it needs more time to transform its economy from a manufacturing and export-dependent

one to a service and consumption one. China might need to slow down and the overall growth figure rate is therefore not relevant.

The growth rate of Japan dropped from the 1.5% (5.9% annualized rate) in Q1 to the -1.7% (-7.1% a.r.) in Q2,

as the hike of national sales tax from 5% to 8% in April might be a factor. However, Japan might still raise the tax rate to 10% in 2015 because of its 200 percent

public debt-to-GDP ratio and its massive deficit, 8.4% of nation's output in 2013. The stimulus of Prime Minister Shinzo Abe to revitalize Japan's economy has been positive, but the combination of the stabilization

of public finances, the maintaining of economic growth, and the implementation of structural reforms might need a perfect balance.

The Germany’s economy declined -0.2% in the second quarter. Some of the contraction was weather-related, but the stagnation of Euro area and the tension with Russia must also be a factor. Southern Europe, the main market of this export-driven economy, is still struggling in the recovery, and Russia, the second market for Germany, is a tit-for-tat sanction fight with the West. The business sentiment is not as confident as in the beginning of the year and the unemployment suddenly rose in August. German counts for one-fifth of EU's output and one-quarter of EU's export. Its monetary policy is a very important voice in EU's finances. At this moment, the government of Chancellor Angela Merkel still maintains its austerity policy and stresses that sustainable growth can be achieved through lower deficits and debts, and painful structural reforms. EU and France think Germany's soft GDP figure of 0.4% in 2013 should support a loosening view in its current policy.

The emerging economies are now struggling with a volatile and uneven picture. Brazil is in recession; Russia managed 0.8% and India still expanded 5.7% growth in Q2 of 2014 as compared to Q2 of 2013.

The United States and Canada

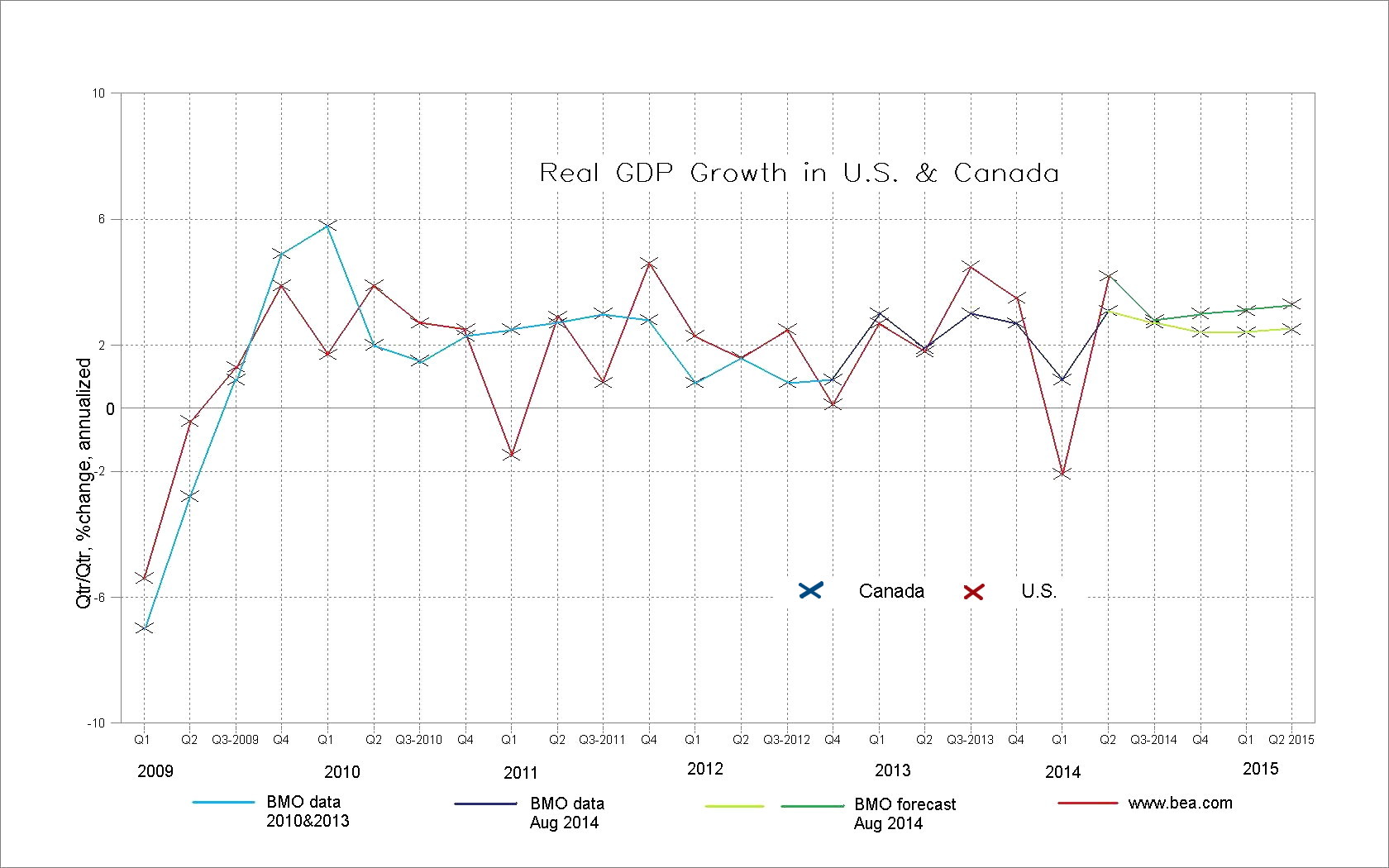

In Q1, northern American states and Canada experienced an unprecedented harsh winter of a new climatic phenomenon of Arctic Vortex, which set the American economy temporary back to -2.1% and the Canadian to 0.9% in Q1. The Q2 figures are 4.2% and 3.1%, respectively.

For the past ten years, the GDP growth trends of the two economies have been similar with a milder recession and a faster initial recovery in Canada and a sharp recession and an uneven but rising recovery in the U.S. The similarity is because of close trade relationship between the two nations, as a matter of fact Canada sends three quarters of its exports to the U.S. The difference of smoothness in the trends might be partially due to the stimulus program in the U.S. and the tight fiscal policy in Canada. One weakness in Canada is her economic structure that has basically two major components – the housing/construction industry and the resource industry, in contrast to the broader and diverse U.S. economy. Canadian real estates are over-priced according to IMF's valuation, and Canada is still looking to find a second accessible market for its resource commodities which are not eagerly sought of under the current global situations.

For employment, the U.S. is likely to continue outperforming Canada. Americans will reach the desired 6.0 or lower percent unemployment rate this year while Canadians remain at a stagnant 7%.

| United States | 2013 Q1 | 2013 Q2 | 2013 Q4 | 2013 Q4 | 2014 Q1 | 2014 Q2 | 2014 Q3 | 2014 Q4 |

| Real GDP (q/q% change,a.r.) | 2.7 | 1.8 | 4.5 | 3.5 | -2.1 | 4.2 | 2.8* | 3.0* |

| CPI (y/y% change) | 1.7 | 1.4 | 1.5 | 1.2 | 1.4 | 2.1 | 2.1* | 2.3* |

| Unemployment Rate (%) | 7.7 | 7.5 | 7.3 | 7.0 | 6.7 | 6.2 | 6.1* | 5.9* |

| CA Balance (%GDP, $b,a.r.) | -422 | -425 | -405 | -349 | -445 | -472* | -440* | -448* |

| Canada | 2013 Q1 | 2013 Q2 | 2013 Q3 | 2013 Q4 | 2014 Q1 | 2014 Q2 | 2014 Q3 | 2014 Q4 |

| Real GDP (q/q% change,a.r.) | 3.0 | 1.9 | 3.0 | 2.7 | 0.9 | 3.1 | 3.0* | 2.0* |

| CPI (y/y% change) | 0.9 | 0.8 | 1.1 | 0.9 | 1.4 | 2.2 | 2.1* | 2.3* |

| Unemployment Rate (%) | 7.1 | 7.1 | 7.1 | 7.0 | 7.0 | 7.0 | 7.0* | 6.9* |

| CA Balance (% GDP, $b,a.r.) | -60.5 | -61.5 | -56.8 | -62.6 | -48.1 | -47.5 | -39.2* | -37.2* |

| *estimates | ||||||||

[ Top | Bottom ] of Page

The U.S. Employment and Stimulus

Back in December 2012, the U.S. Federal Reserve announced to start the quantitative easing stimulus (QE3) of $85 billion per month debt buying program. The stimulus was designed to improve the employment and growth situations; the unemployment rate stood at 8.1%. Today, the American economy has reached a target unemployment rate of about 6 percent — 6.10% in August and 6.2% in July.

In December 2013, the Fed announced to start the tapering of the stimulus by cutting both treasury bond and mortgage backed securities program — in January, February, April, May, July and August, each $10billon/month. The buying program is now at $25b/month, and the program is expected to end in October 2014 when the unemployment rate will be at about 6%.

The employment situation has brightened a bit, nevertheless the Fed still concerns about underemployment and slow wage growth in the labour market and is reluctant to give a hint about the timetable of the normalisation of interest rate. They also do not want to initiate undesirable movements in the capital market. Some economists thus forecast the first hike may come by the middle of 2015.

The Capital Markets

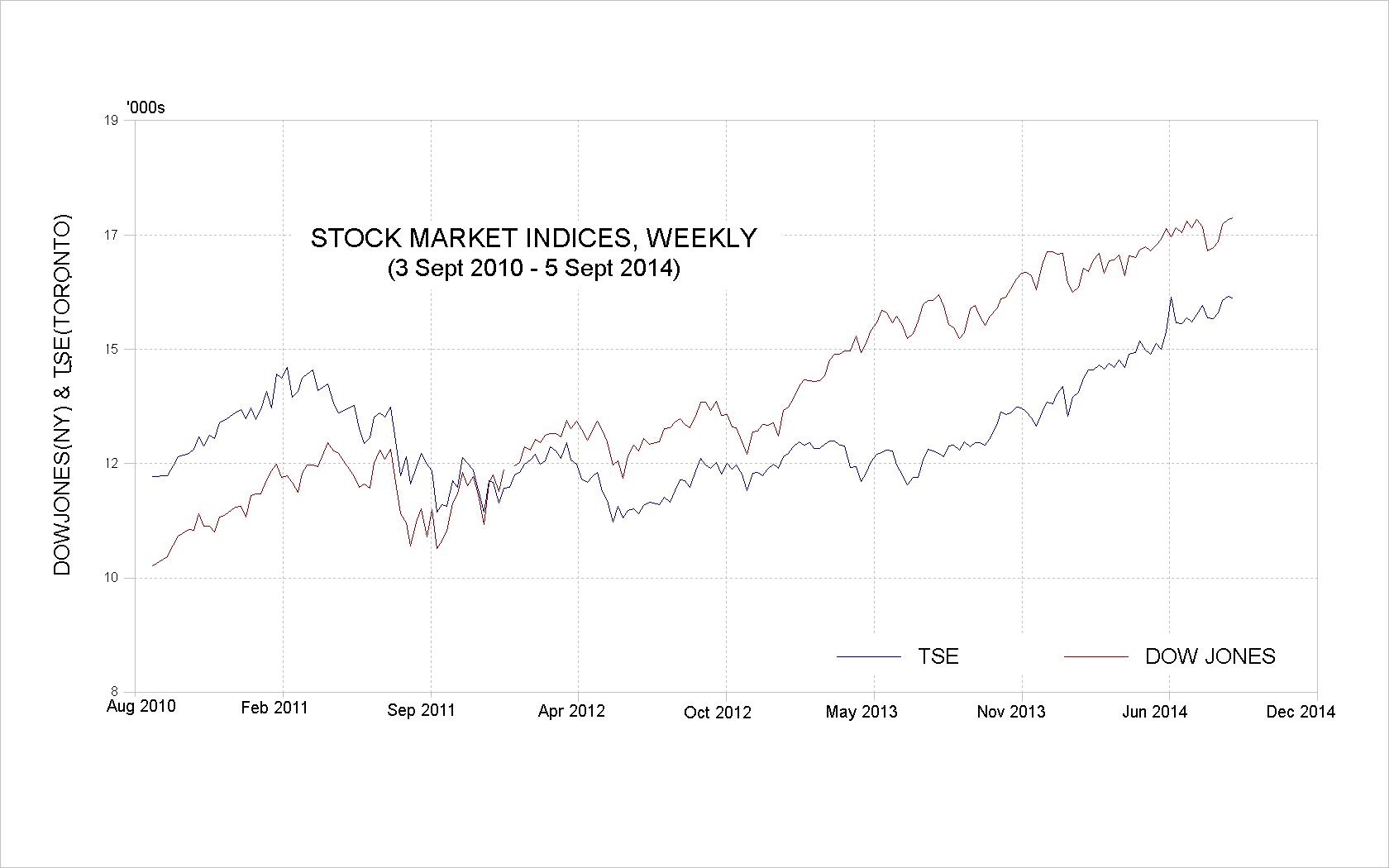

In the past two years, the Canadian stock market was in the doldrums while the U.S. markets surpassed the junction with the Canadian about the beginning of 2012 and roared upwards. By the end of 2013, the Canadian began to catch up with the U.S. counterparts, although the bullish trend might not be sustained. On Friday, September 12, the Dow Jones closed at 16,987 point and the Toronto TSX at 15,531 (Fig. 1). The SP500 reached the highest point of 1,985 and the NASDAQ was 4,567, elsewhere the Nikkei was 15,948 and the HangSeng was 24,495. All these indices are slightly of their record highs which were achieved recently.

The stock markets of emerging economies lagged behind the North American peers, though their performances were still positive with a return of 6.4% in the first half of the year. In contrast to the expectation in the beginning of 2014, the bonds still held up in North America and generated a positive return in the first six months of the year, while the global bonds were mostly positive with the emerging economies outperforming the more stable countries, in spite of the capital outflow.

GLOBAL OUTLOOK

The world is at a the junction of unpredictable paths — war or peace, adversity or prosperity, etc.. The economy is still very fragile with unstable and uneven recovery. The International Monetary Fund (IMF) anticipates a growth rate of 3-to-3.5% for the world in 2014 The other forecasts are shown in the following table:

| World | U.S. | EU | Japan | Germany | France | U.K. | Italy | Canada | Russia | China | India | Brazil | |

| 2014 | 3.4 | 1.7 | 1.1 | 1.6 | 1.9 | 0.7 | 3.2 | 0.3 | 2.2 | 0.2 | 7.4 | 5.4 | 1.3 |

| 2015 | 4.0 | 3.0 | 1.5 | 1.1 | 1.7 | 1.4 | 2.7 | 1.1 | 2.4 | 1.0 | 7.1 | 6.4 | 2.0 |

The United States leads the global economy again, while the Euro area stalls and in the danger of sliding into deflation phase. The U.S. employment is improving but there is no immediate fear of inflation because of the slack in the job market and the still cautious spending of their consumers.

The U.S. manufacturers are still improving their productivities. With improving corporation earnings and employment situation, the American stocks

may outperform Canadian's again next year. The public indebtedness is improving but still at a very high level, thus the Federal, state and municipal governments are

forced to continue trimming their budgets that affects the growth and effectuates a weak recovery. The Federal Reserve is expected to keep the low interest rates as long as possible

until the economy is no longer fragile, therefore both U.S. stock and bond markets could rise simultaneously in the coming months

under this unusual low interest environment. As the stabilization of interest rate, the economy and the inflation will rise gradually. The stock prices could rise and the bonds

may weaken.

The long-term global picture is gloomier, as the population expands and nations compete each other for trades and the limited natural resources.

Global warming and the climatic consequences become a reality and not a scientific theory. In a recent interview with Deutsche Welles, Prof. Alvin Roth, who won the 2012 Nobel Prize in economic sciences, said that the quality of life had been much-improved last century and he was optimistic about the future. Now, we can see in the future whether human innovations can outpace the damage to the world capital by the nature calamities.

Also no accuracy of figures or information are guaranteed.